38 zero coupon bond benefits

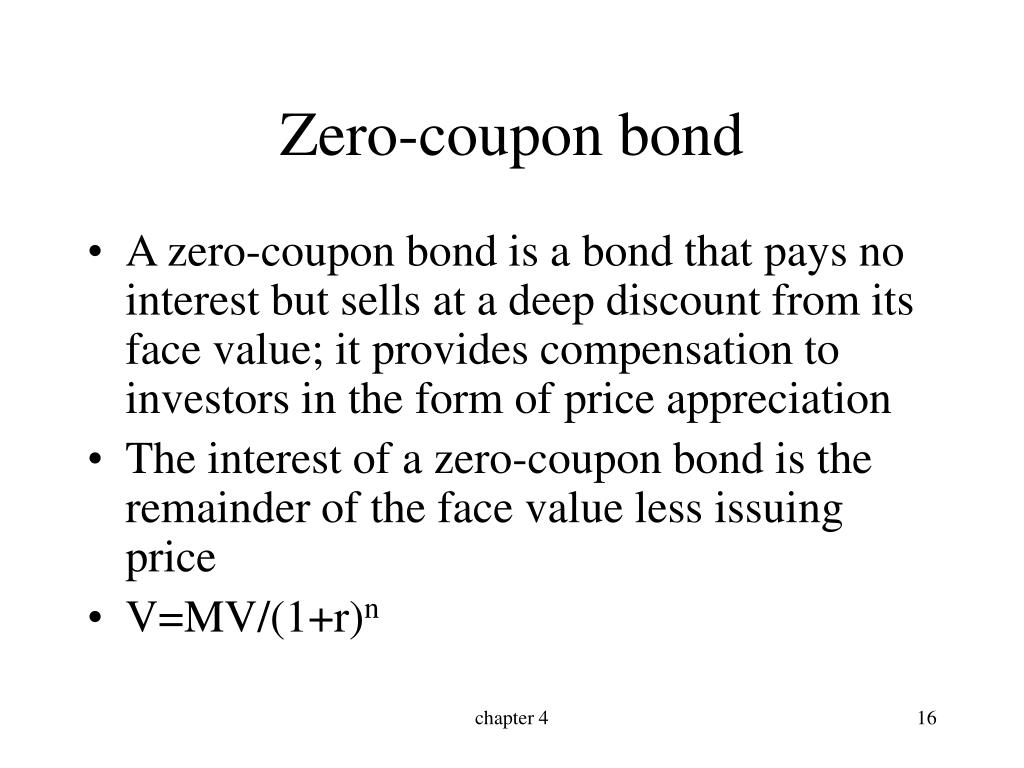

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond fund is a fund that contains zero coupon bonds. Zero coupon bonds don't pay interest, but they are purchased at a steep discount and the buyer receives the full par value upon maturity. Zero coupon bond funds can be structured as a mutual fund or an ETF. Zero coupon bonds typically experience more price volatility than other ...

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Zero coupon bond benefits

What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. money.usnews.com › investing › bondsHow Bond Maturity Works - US News & World Report Mar 12, 2020 · A savings bond is an example of a zero-coupon bond because the interest payments are added to the ... Issuers may want to redeem the bond early if interest rates change in a way that benefits them. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero coupon bond benefits. Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero-Coupon Bonds facilitates the reliable source for fixed returns provided you keep our investment until maturity. A fixed return can be earned without worrying of the market chaos. No Reinvestment Risks Zero-Coupon Bonds helps you avoid reinvestment risks. With Zero-Coupon Bonds there is no periodic coupon payment. Zero-Coupon Bond: Formula and Calculator [Excel Template] Zero-Coupon vs Traditional Coupon Bonds Unlike zero-coupon bonds, traditional coupon bonds with regular interest payments come with the following benefits: Source of Recurring Income for Bondholder Interest Payments Derisk the Lending (i.e. Raises "Floor" on Maximum Potential Loss) Consistent, Timely Interest Payments Confirms Credit Health › index › calculatorsMicrosoft Excel Bond Yield Calculations | TVMCalcs.com We know that the bond carries a coupon rate of 8% per year, and the bond is selling for less than its face value. Therefore, we know that the YTM must be greater than 8% per year. You need to remember that the bond pays interest semiannually, and we entered Nper as the number of semiannual periods (6) and Pmt as the semiannual payment amount (40). › articles › investingDifferent Types of Swaps - Investopedia Aug 15, 2022 · If ABC, Inc. does not default during the 15-year long bond duration, Paul benefits by keeping the $15 per year without any payables to Peter. ... Zero Coupon Swaps . ... Benefits: The zero coupon ...

What are Zero Coupon Bonds? Types, Advantages & Disadvantages Another reason why Zero Coupon Bonds issued by private firms can be attractive is that they can provide diversification benefits. This is because the performance of these bonds is often not correlated with other asset classes such as stocks and real estate. This means that they can help to reduce overall portfolio risk. › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. › government-bondsGovernment Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction.

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Advantage of Zero-Coupon Bonds From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. Zero Coupon Bond -Features, benefits, drawbacks, taxability ... - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. What Is a Zero-Coupon Bond? Definition, Characteristics & Example For instance, if a zero-coupon bond was sold at a $100 discount and matures in four years, its holder would have to pay the applicable bond interest tax rate on $25 worth of the bond's total $100 ... Zero-Coupon Bond - an overview | ScienceDirect Topics Moorad Choudhry, in The Bond & Money Markets, 2001. 14.5.2 Bond interest payment. Corporate bonds pay a fixed or floating-rate coupon. Floating-rate bonds were reviewed in Chapter 5. Zero-coupon bonds are also popular in the corporate market, indeed corporate zero-coupon bonds differ from zero-coupon bonds in government markets in that they are actually issued by the borrower, rather than ...

Understanding Zero Coupon Bonds - Part One - The Balance Municipal zero coupon bonds are free from federal income tax like regular municipal bonds. The major credit agencies rate most zero coupon bonds for credit worthiness. This rating can change during the life of the bond, which can affect the price.

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them...

Zero-coupon bond financial definition of Zero-coupon bond A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value. Zero-coupon bonds are subject to very large price fluctuations.

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

What is a zero-coupon bond? What are the advantages and risks? Answer (1 of 2): A zero coupon bond is a bond that pays no cash interest until maturity. All the interest accrues and is paid with the final principal payment. An advantage is that the rate of return on your investment is locked in when you buy it. You're not subject to reinvestment risk, or the ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Also, each year, many new zero-coupon bonds are issued. Despite there being so many zero-coupon bonds, the issues get sold out relatively easily. These bonds are so popular because they have certain advantages. Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it.

Pros and Cons of Zero-Coupon Bonds | Kiplinger With retirement years away for you and today's low interest rates, we'd advise against buying zeros. These bonds don't make regular interest payments. Instead, they're sold at a big discount to ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed. ... The Benefits and Risks of Being a Bondholder.

smartasset.com › investing › face-value-of-a-bondWhat Is the Face Value of a Bond? - SmartAsset Jan 15, 2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity. Hence, they trade at a deep discount. The bond pricing varies with time to maturity . The higher the time until maturity, lower will be the price the ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Post a Comment for "38 zero coupon bond benefits"