38 duration of a coupon bond

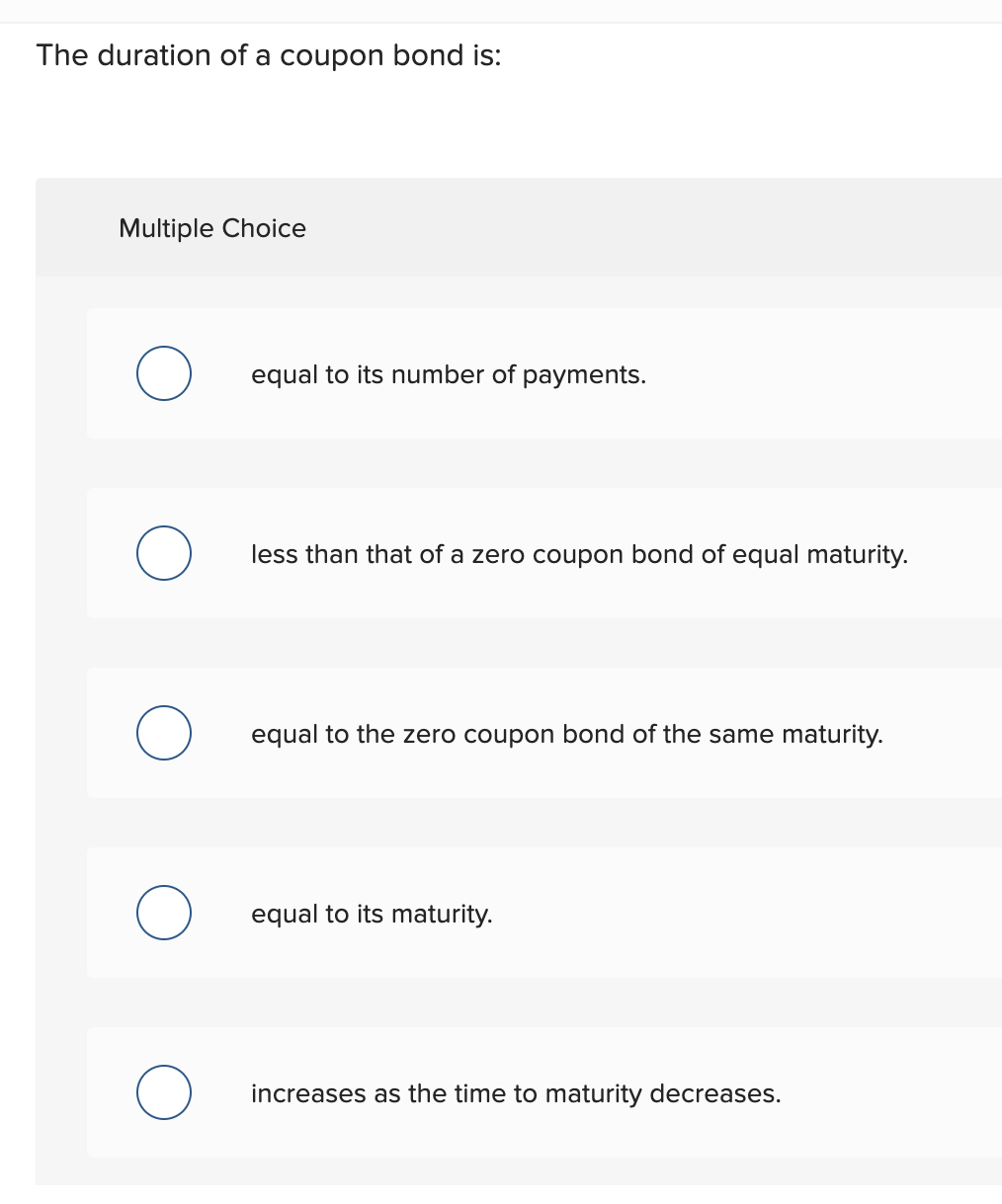

What is the duration of a bond? and How to Calculate It? The duration of a bond does not represent the duration for which an investor holds a bond. Instead, it refers to the relationship between the price of a bond and interest rates of the bond after considering its different characteristics such as yield, coupon rate, maturity, etc. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... Macaulay Duration vs. Modified Duration: What's the Difference? Bonds. How the Face Value of a Bond Differs From Its Price.

Bond fund - Wikipedia A bond fund or debt fund is a fund that invests in bonds, ... Bond duration Funds invest in different maturities of bonds. ... price, face value, coupon rate, ...

Duration of a coupon bond

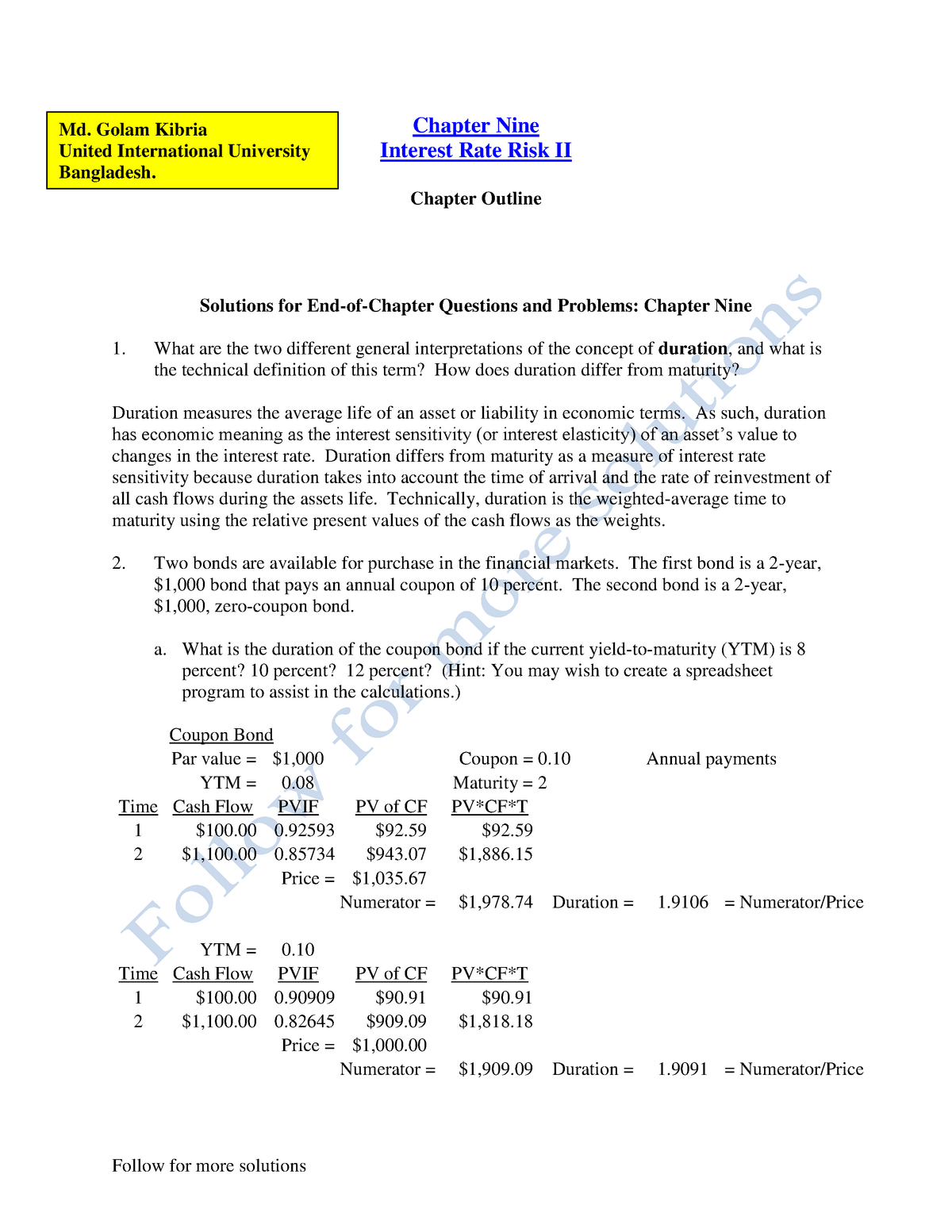

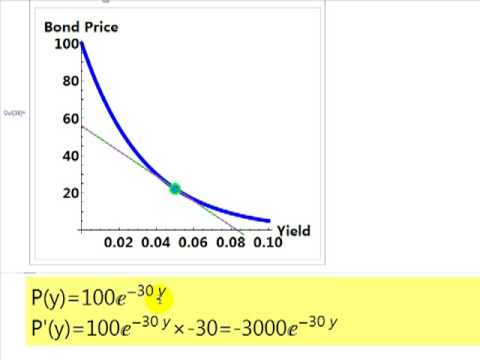

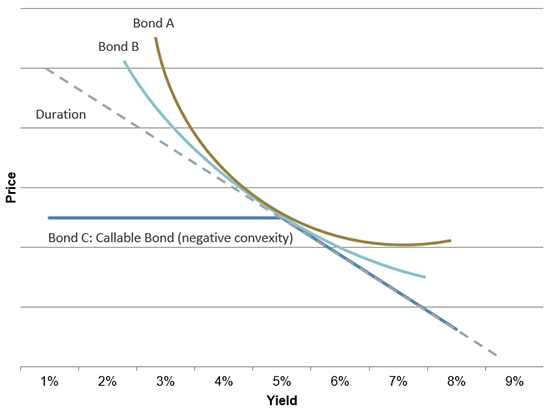

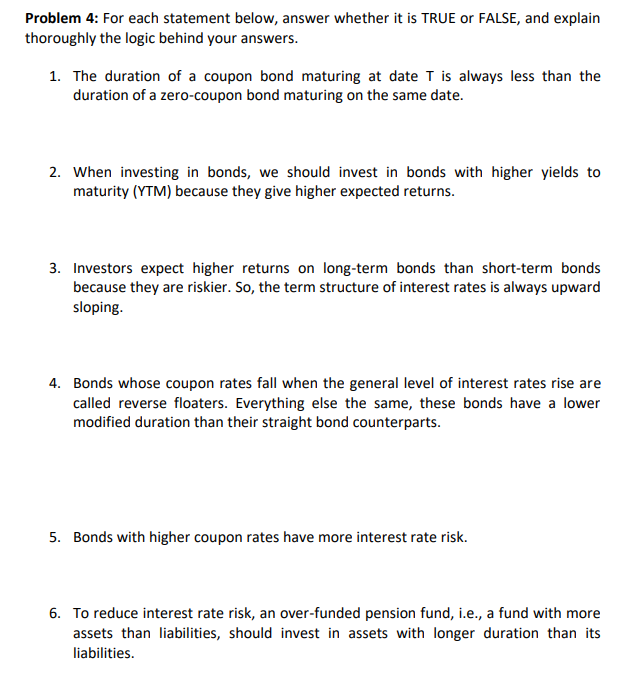

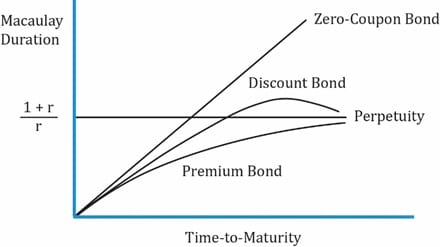

Duration and Convexity to Measure Bond Risk - Investopedia Jun 22, 2022 · The duration of a zero-coupon bond equals time to maturity. Holding maturity constant, a bond's duration is lower when the coupon rate is higher, because of the impact of early higher coupon payments. What Is Duration of a Bond? - TheStreet Definition - TheStreet Oct 03, 2022 · When a coupon is added to a bond, the duration will always be less than its maturity. Short and Medium-Term Bonds. In a nutshell, the general rule is that for every 1% increase in interest rates ... Duration: Understanding the relationship between bond prices ... That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date.

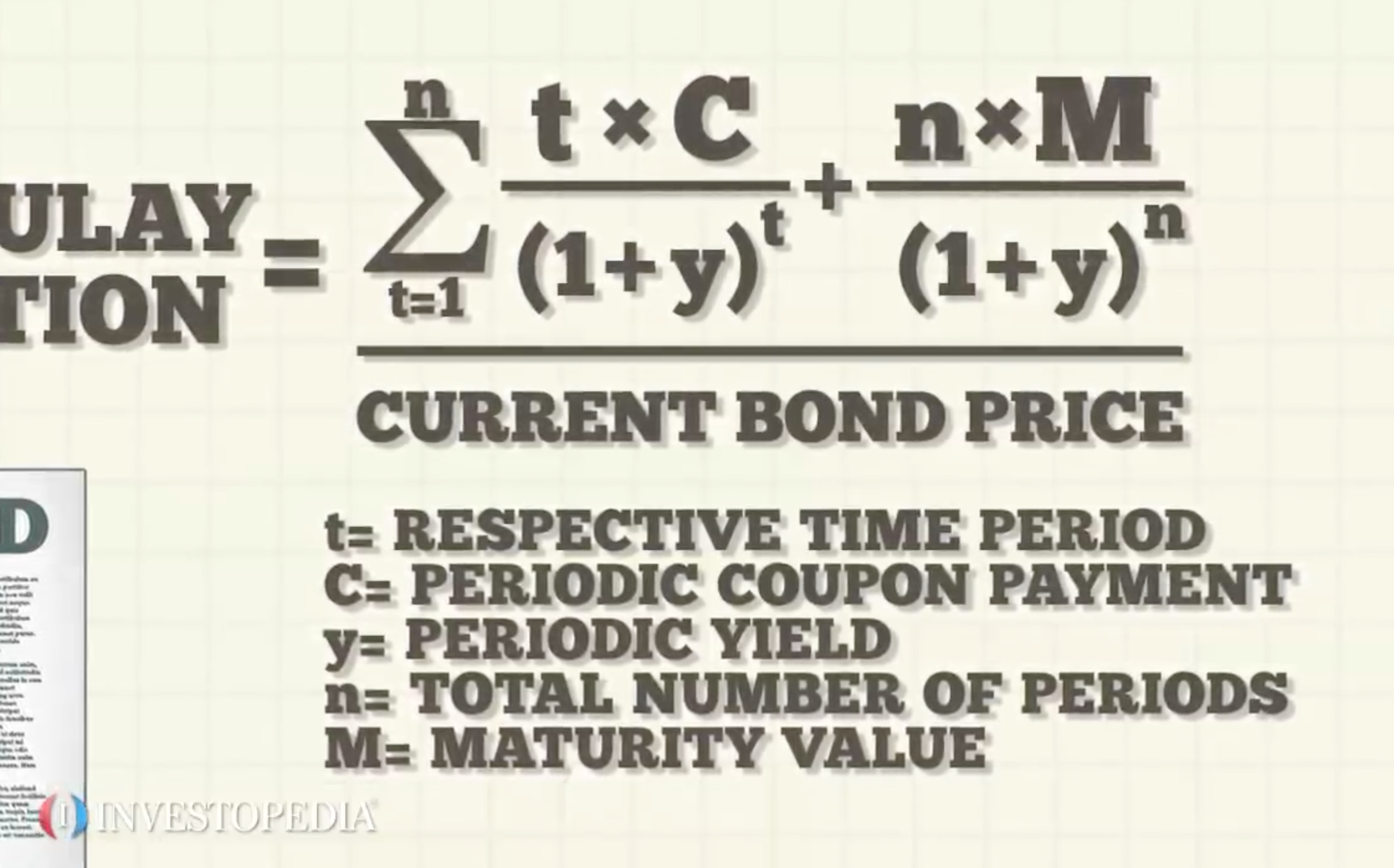

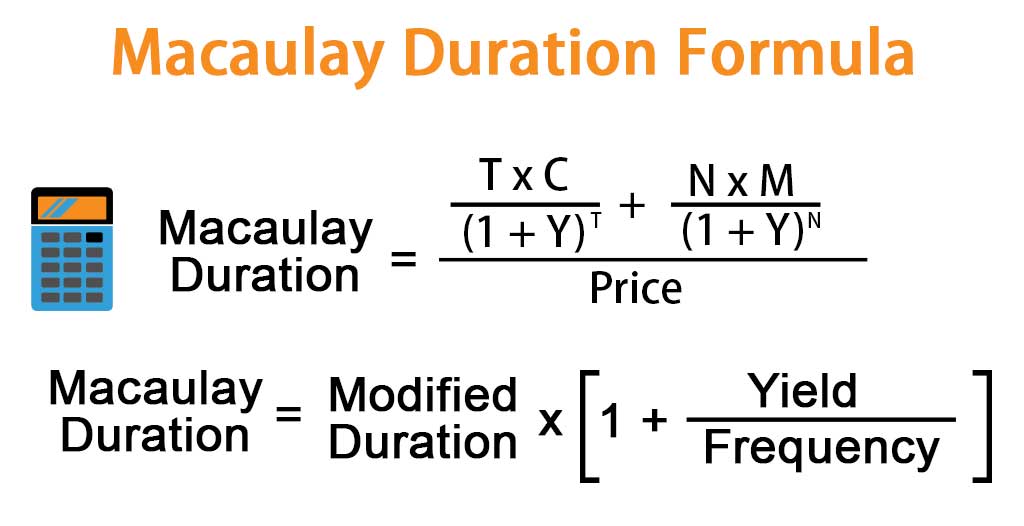

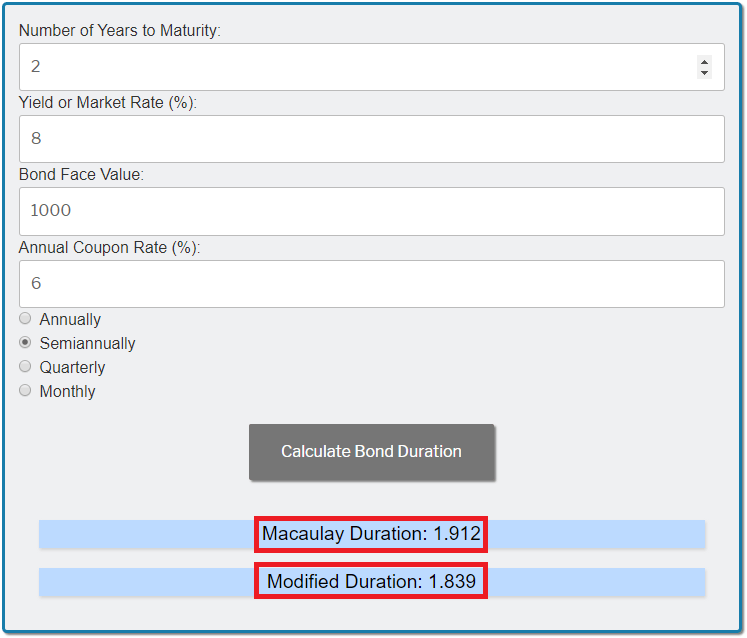

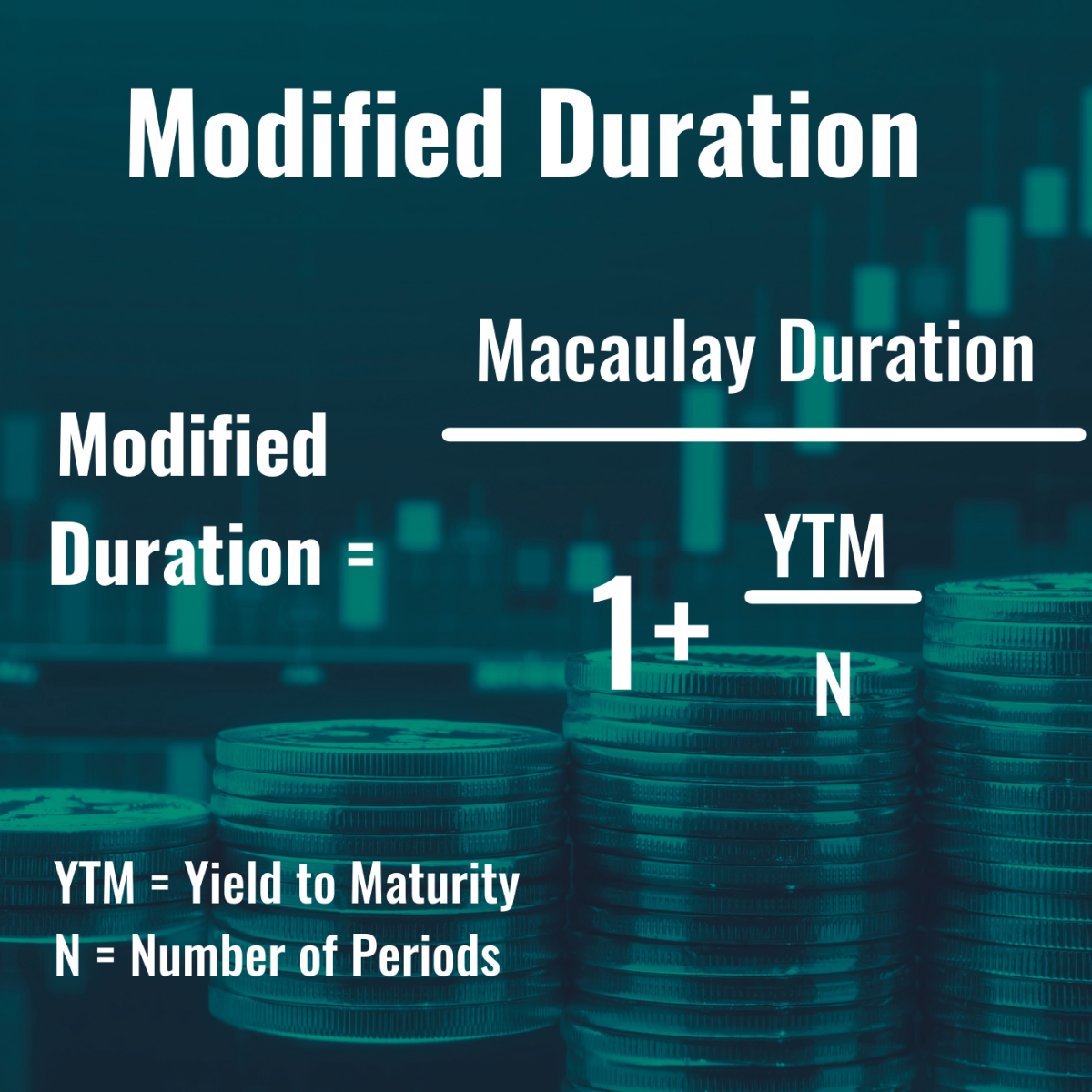

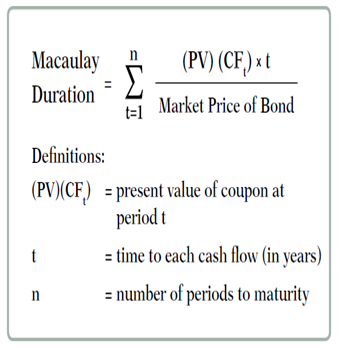

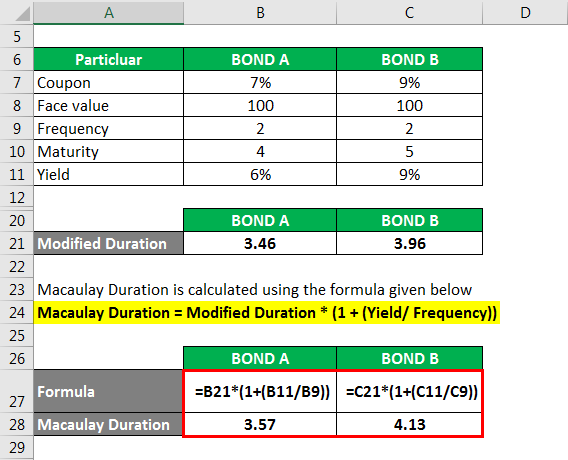

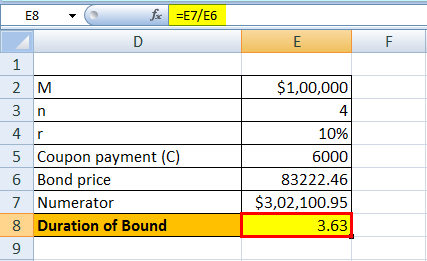

Duration of a coupon bond. What Is the Macaulay Duration? - Investopedia Sep 29, 2022 · Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ... Duration: Understanding the relationship between bond prices ... That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. What Is Duration of a Bond? - TheStreet Definition - TheStreet Oct 03, 2022 · When a coupon is added to a bond, the duration will always be less than its maturity. Short and Medium-Term Bonds. In a nutshell, the general rule is that for every 1% increase in interest rates ... Duration and Convexity to Measure Bond Risk - Investopedia Jun 22, 2022 · The duration of a zero-coupon bond equals time to maturity. Holding maturity constant, a bond's duration is lower when the coupon rate is higher, because of the impact of early higher coupon payments.

![Duration and Convexity [Concepts Series] | by Byrne Hobart ...](https://miro.medium.com/max/934/1*sId1I-O1GXScie24NpUXyQ.png)

:max_bytes(150000):strip_icc()/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "38 duration of a coupon bond"