39 is yield to maturity the same as coupon rate

Difference between Coupon Rate And Yield To Maturity The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to maturity undergoes a change depending on various factors such as the years remaining till maturity and the current price at which the bond is being traded. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

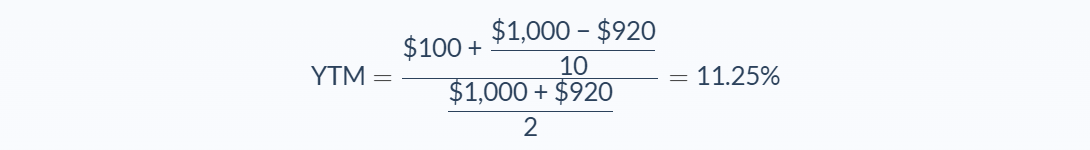

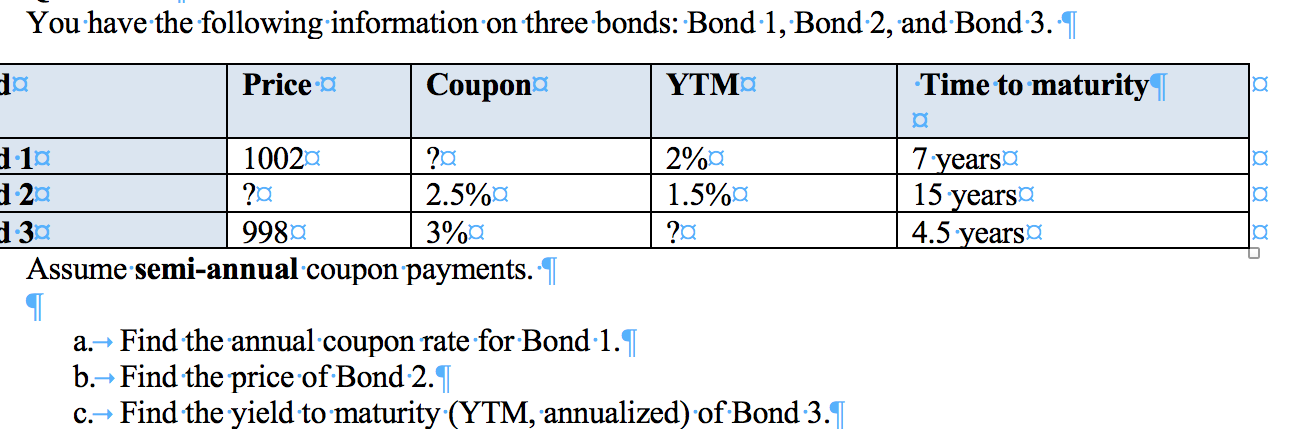

Can yield to maturity be higher than coupon rate? - Sage-Answer Is current yield the same as coupon rate? ... If a bond's yield to maturity exceeds its coupon rate, the bond will sell at a discount below par. Three $1,000 par value, 10-year bonds have the same amount of risk, hence their yields to maturity are equal. How do you calculate coupon rate?

Is yield to maturity the same as coupon rate

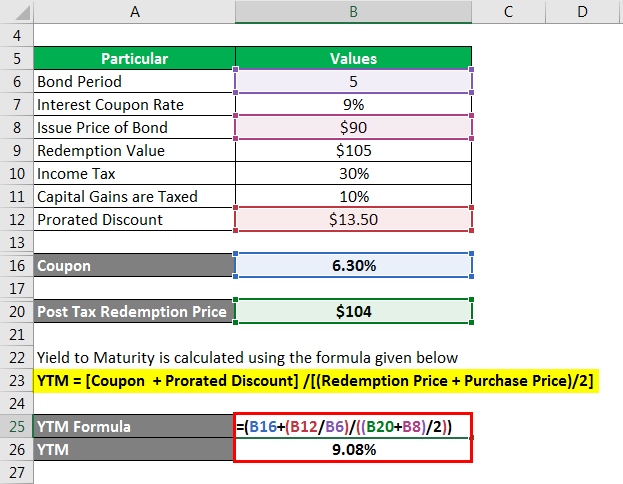

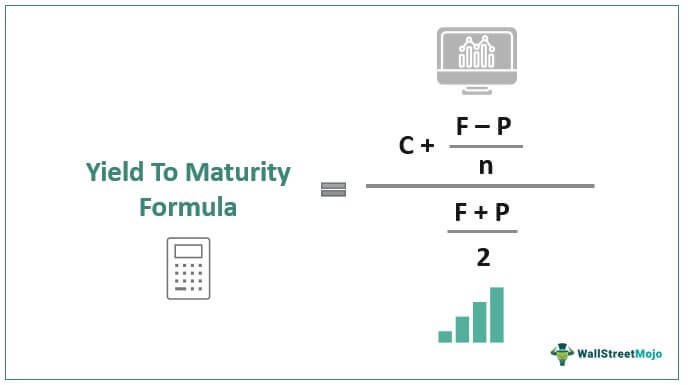

Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver. Yield to Maturity: Definition, Formula, Pros & Cons Yield to maturity (YTM) is the overall rate of return that a bond will have earned once all interest payments are made. Read on to learn more. ... Given that coupon payments are not always reinvested at the same interest rate, the yield to maturity (YTM) is only a snapshot of the return on a bond. ... The bond's coupon rate is 15%, and its ... Yield to Maturity (YTM): Formula and Bond Calculation Assumption #3 → The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). The yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price.

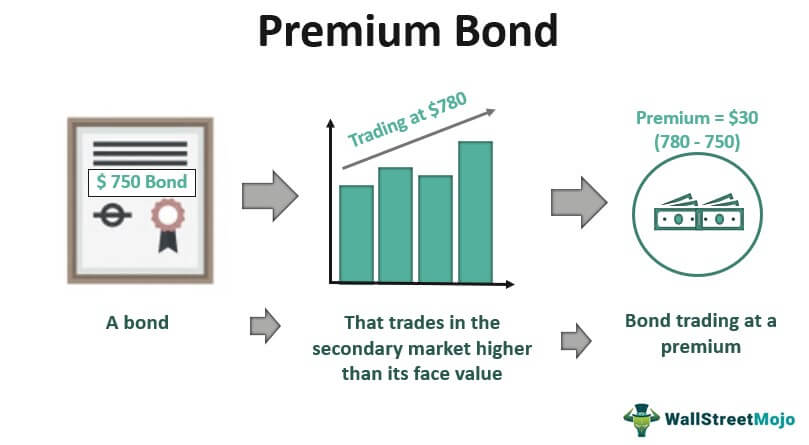

Is yield to maturity the same as coupon rate. Solved If the yield to maturity and the coupon rate are the - Chegg Finance questions and answers. If the yield to maturity and the coupon rate are the same, then the bond should sell for ______.a. a premium b. a discount c. par valueTo answer enter a, b, or c. SubmitAnswer format: Text. When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · Conversely, a bond purchased at a premium always has a yield to maturity that is lower than its coupon rate. Yield to maturity approximates the average return of the bond over its remaining term. Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return (IRR ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

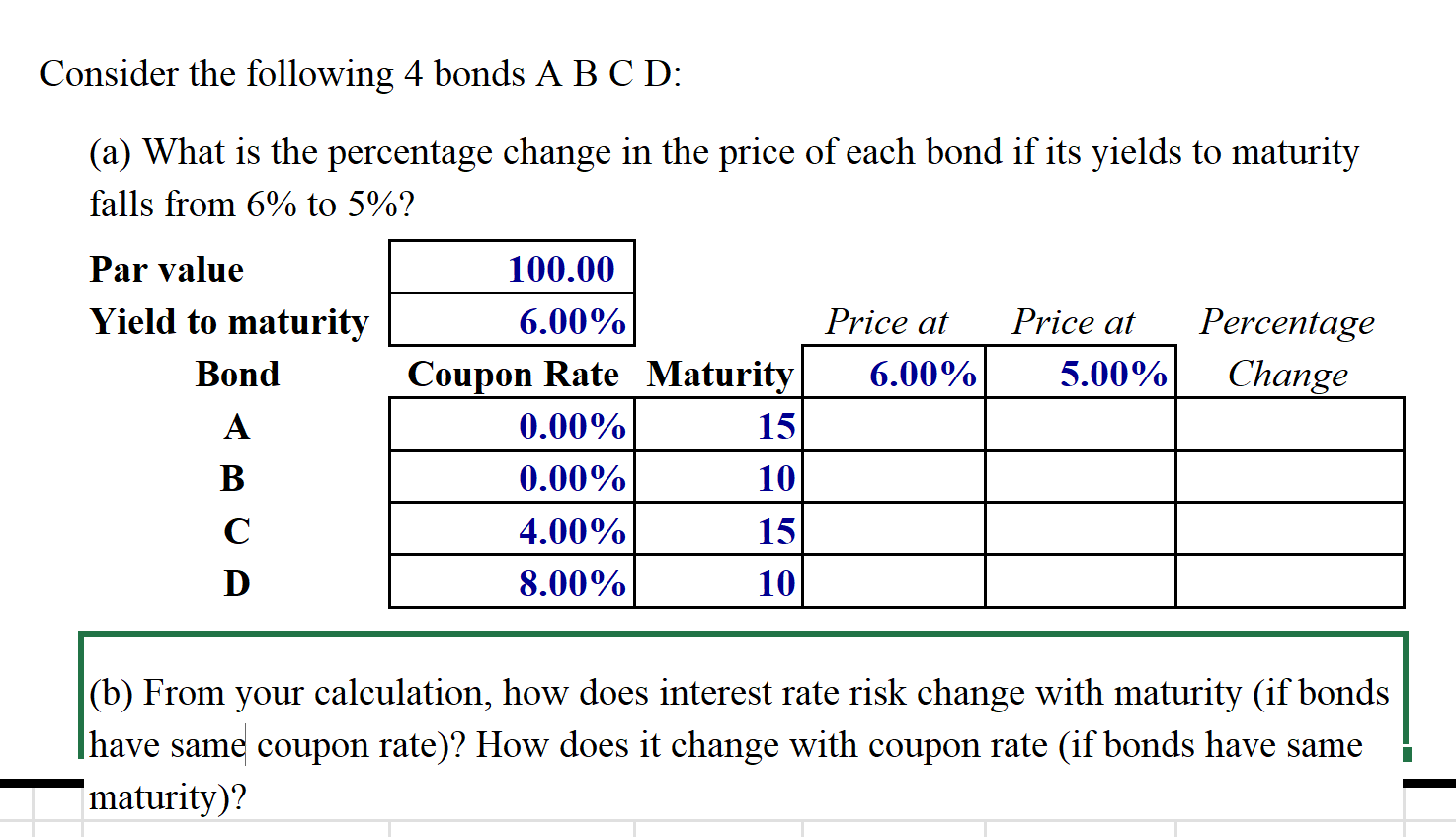

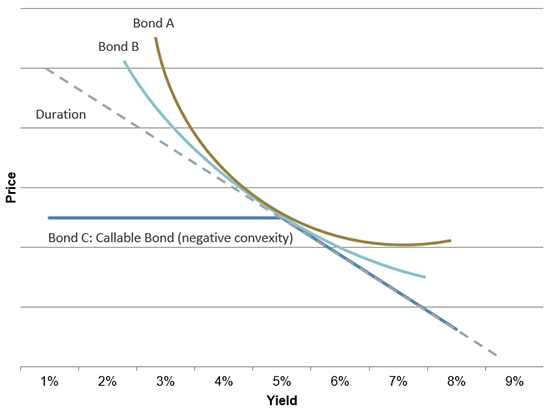

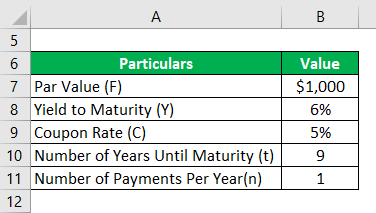

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ... Assume both yield to maturity and coupon rate are 5. Assume both yield to maturity and coupon rate are constant through time. As time goesby, the price premium of a premium bond would gradually: A) Increase B) Decrease C) Increase then decrease D) None of the above. 6. With other conditions unchanged, the price sensitivity of a bond to changes in interest rate is higher, when: A) the bond has ... Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Is the Yield to Maturity on a Bond the Same Thing As the Required ... In contrast to yield to maturity, required return starts with yield and works backward to determine the price. For example, say a corporation needs to raise capital, and it is preparing to issue 10-year, $1,000 bonds at a coupon rate of 5 percent. When it comes time to sell the bonds, however, similar investments are paying a 9 percent annual ...

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond. Difference in Yield to Maturity and Coupon Rate of Bond| Why Yield and ... In this video we have discussed the general doubt of many people that why yield to maturity and coupon rate are not same in the bond market and what it makes... Key Differences: Bond Price vs. Yield - SmartAsset The prevailing interest rate stays the same as the bond's coupon rate. The par value is set at 100, which means that buyers will pay the full price for the bond. ... Yield to Maturity (YTM) - This is the total return investors earn when they hold the bond until it matures. Like the coupon or nominal yield, it's often quoted as an annual ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

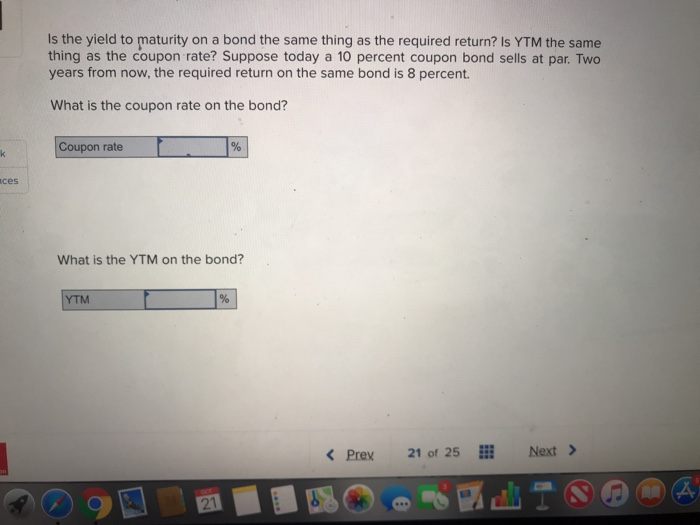

Is the yield to maturity on a bond the same thing as the required ... It should be noted that the yield to maturity on a bond is also the same thing as the required return.. The yield to maturity is simply the required rate of return on a bond. They are typically used interchangeably. Furthermore, the YTM is not the same thing as the coupon rate. YTM is the percentage rate of return while the coupon rate is the annual amount of interest that the bond owner will ...

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A yield to maturity calculation assumes that all the coupon payments are reinvested at the yield to maturity rate. This is highly unlikely because future rates can't be predicted.

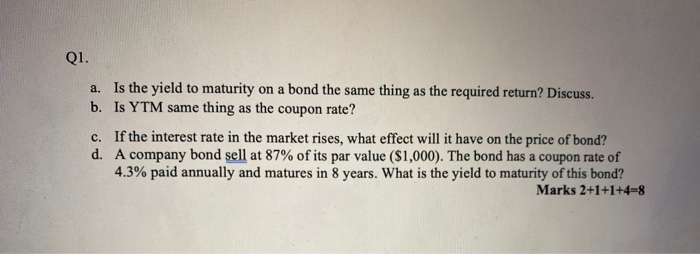

Solved Is the yield to maturity on a bond the same thing as - Chegg You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer. Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent.

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate.

Yield to Maturity (YTM): Formula and Bond Calculation Assumption #3 → The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). The yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price.

Yield to Maturity: Definition, Formula, Pros & Cons Yield to maturity (YTM) is the overall rate of return that a bond will have earned once all interest payments are made. Read on to learn more. ... Given that coupon payments are not always reinvested at the same interest rate, the yield to maturity (YTM) is only a snapshot of the return on a bond. ... The bond's coupon rate is 15%, and its ...

Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver.

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "39 is yield to maturity the same as coupon rate"