45 relationship between coupon rate and ytm

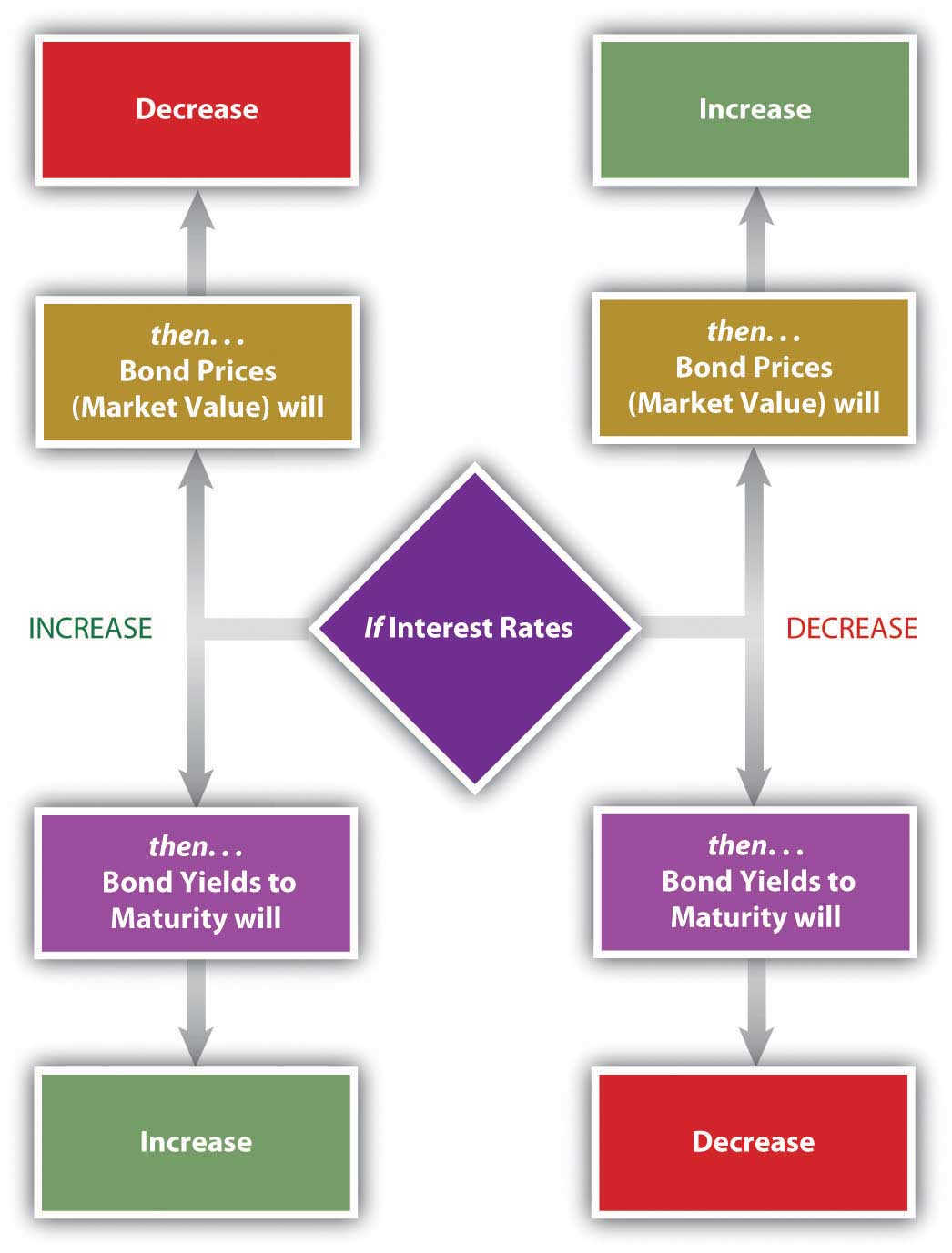

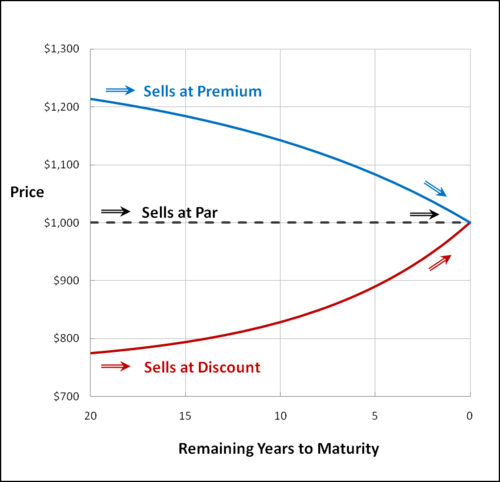

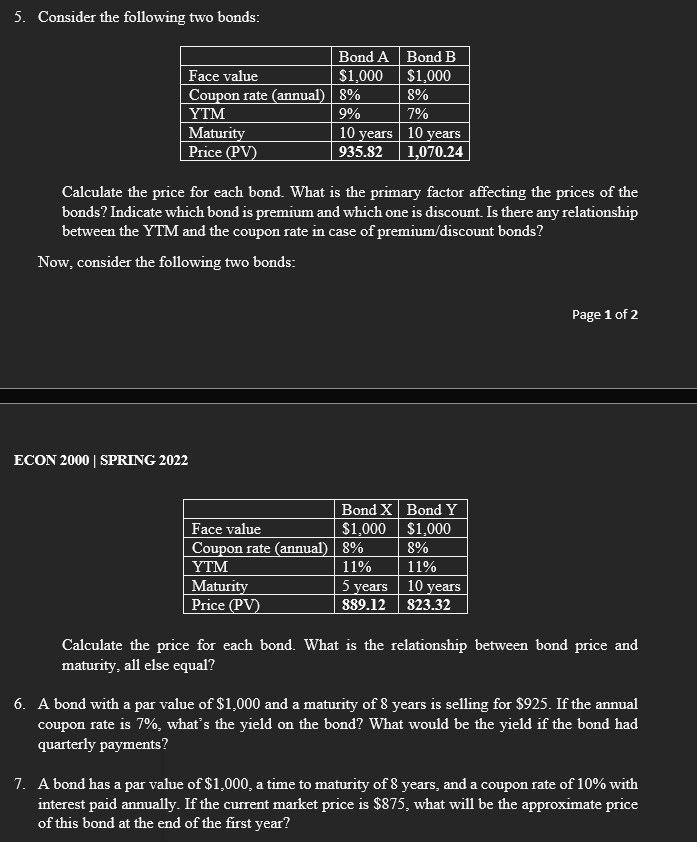

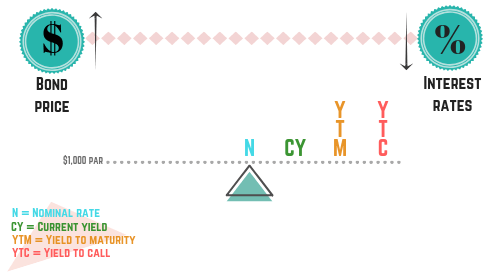

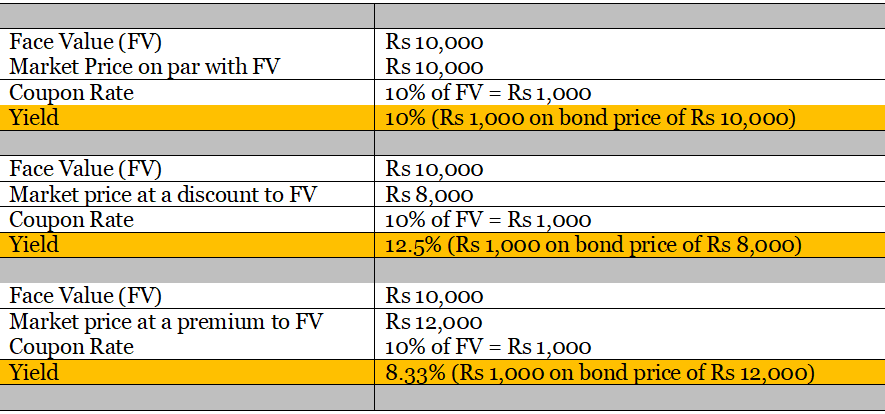

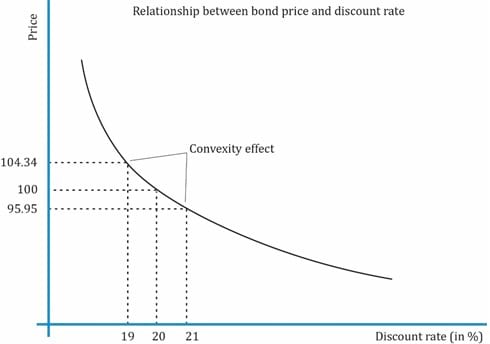

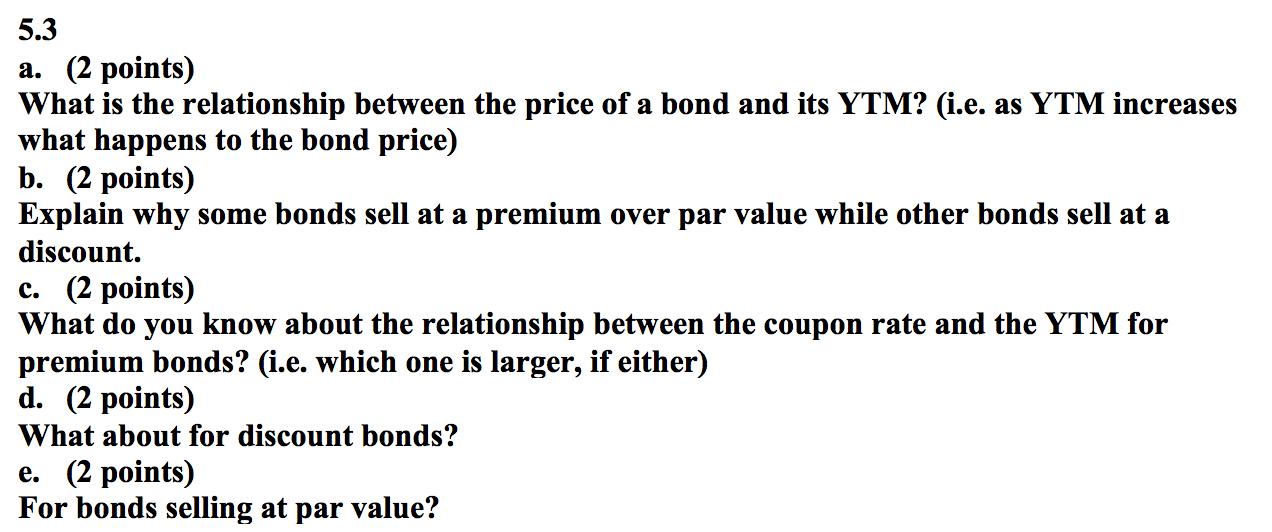

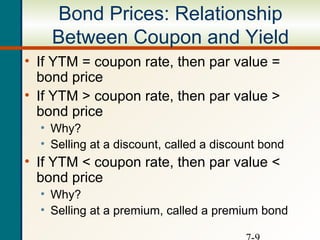

› commonman › EnglishReserve Bank of India The relationship between yield to maturity and coupon rate of bond may be stated as follows: When the market price of the bond is less than the face value, i.e., the bond sells at a discount, YTM > > coupon yield. When the market price of the bond is more than its face value, i.e., the bond sells at a premium, coupon yield > > YTM. › fixed-income-essentials-4689775Fixed Income - Investopedia Dec 05, 2021 · Matilda Bond: A bond denominated in the Australian dollar and issued on the Australian market by a foreign entity that seeks to raise capital from Australian investors. A Matilda Bond may attract ...

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Relationship between coupon rate and ytm

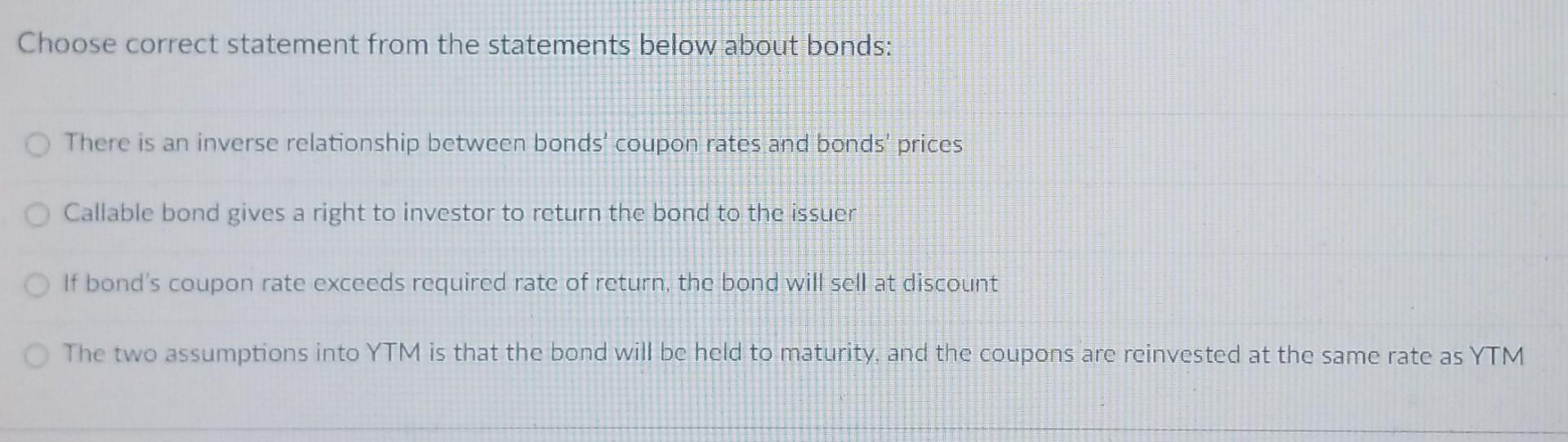

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Examples Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. quizlet.com › 100837706 › fin-3403-ch-7-bonds-andFIN 3403 - CH 7 - Bonds and Bond Valuation Flashcards - Quizlet YTM Current Yield 4.06% ... 5 million bonds with a par value of $5000 each for 10 years at a coupon rate of 7%. ... relationship between market interest rates and ...

Relationship between coupon rate and ytm. monevator.com › dont-currency-hedge-your-equityDon't currency hedge your equity portfolio - Monevator Sep 29, 2022 · The relationship between currency movements and inflation also causes a natural hedge. Since the UK imports pretty much everything – including labour – a lower value of GBP increases inflation in the long run. But at the same time, a lower value of GBP would boost the value of your (unhedged) foreign portfolio. quizlet.com › 100837706 › fin-3403-ch-7-bonds-andFIN 3403 - CH 7 - Bonds and Bond Valuation Flashcards - Quizlet YTM Current Yield 4.06% ... 5 million bonds with a par value of $5000 each for 10 years at a coupon rate of 7%. ... relationship between market interest rates and ... › knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Examples Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "45 relationship between coupon rate and ytm"