39 treasury zero coupon bond

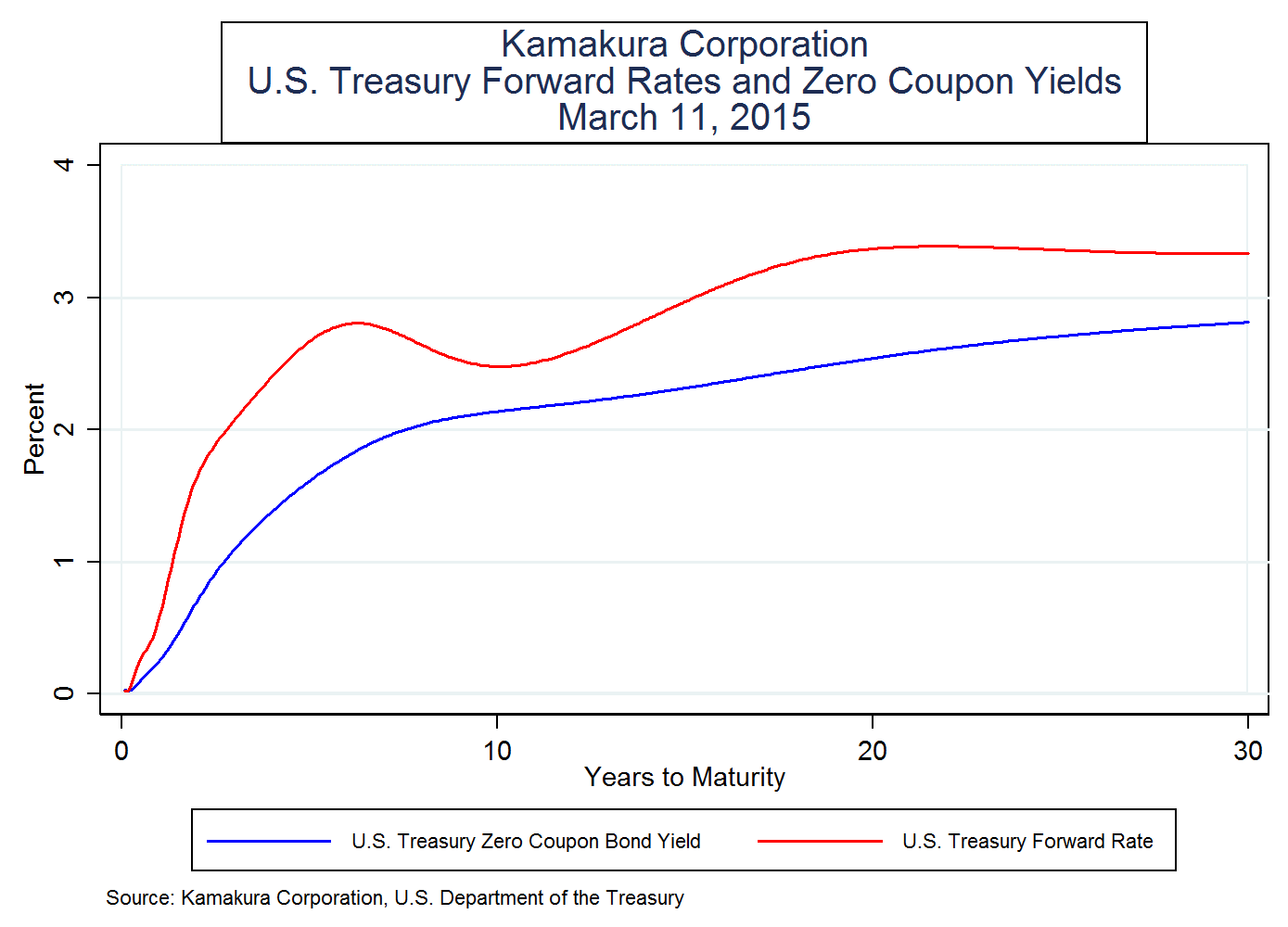

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ... PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange ... 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund ... of Securities (STRIPS) representing the final principal payment of U.S. Treasury bonds.

› ZROZZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF - ETF.com Oct 27, 2022 · Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news.

Treasury zero coupon bond

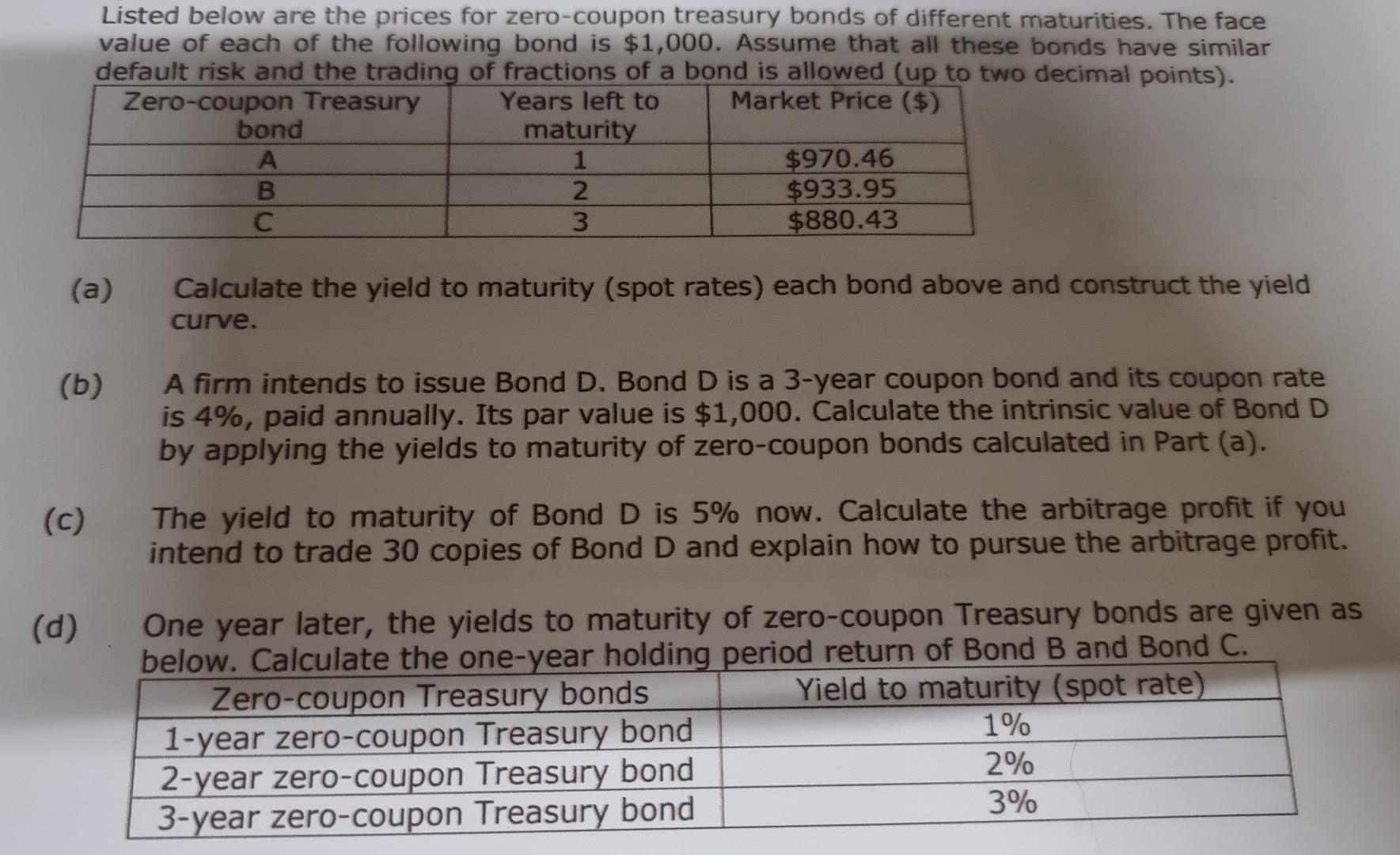

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. › terms › tTreasury Yield: What It Is and Factors That Affect It May 25, 2022 · Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ... en.wikipedia.org › wiki › Government_bondGovernment bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending. It generally includes a commitment to pay periodic interest , called coupon payments, and to repay the face value on the maturity date.

Treasury zero coupon bond. Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall.1 However, ... › investing › bondTMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 ... With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ...

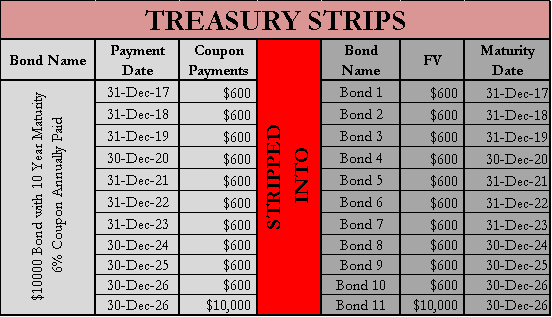

Zero Coupons and STRIPS - Federal Reserve Bank of New York Zero Coupons and STRIPS. This content is no longer available. Please see TreasuryDirect – STRIPS for current information on this subject. en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals ... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. US Treasury Zero-Coupon Yield Curve - Nasdaq Data Link Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a ...

Zero Coupon Bond - Investor.gov Nov 10, 2022 ... Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep ... Continued Treasury Zero Coupon Spot Rates - TreasuryDirect Interest Rates and Prices SLGS Daily Rate Table IRS Tax Credit Bond Rates ... Zero Coupon Spot Rates Average Interest Rates on U.S. Treasury Securities UTF ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks Jul 28, 2022 ... A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. · Zeros-coupon ... en.wikipedia.org › wiki › Government_bondGovernment bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending. It generally includes a commitment to pay periodic interest , called coupon payments, and to repay the face value on the maturity date.

› terms › tTreasury Yield: What It Is and Factors That Affect It May 25, 2022 · Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ...

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

:max_bytes(150000):strip_icc()/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 treasury zero coupon bond"